Stellar (XLM) to USD live price has carved out a niche in the Bitcoin ecosystem. Starting in 2014, under the direction of Jed McCaleb, co-founder of Ripple and Mt. Gox, Stellar was also run under the Stellar Development Foundation (SDF). Transaction fees and network minimum balances are paid from Lumens (XLM), its native asset.

For traders, investors, and blockchain aficionados, Stellar’s real-time price swings versus the U.S. Dollar (USD) are now the central focus. Understanding the XLM to USD live price is vital for both short-term traders and long-term investors as rising use cases in remittances, distributed finance (DeFi), and token issuing call for both.

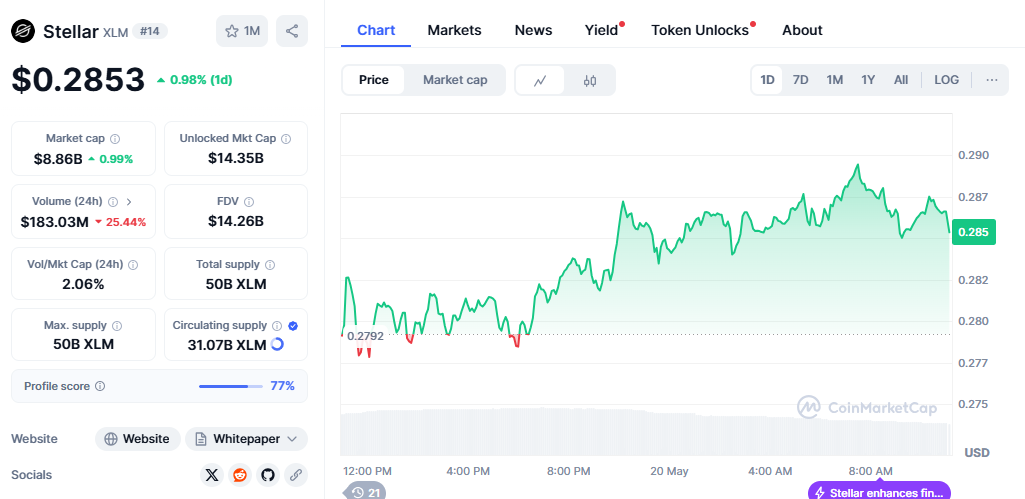

Today’s Stellar Price and Current Market Sentiment

Reacting to macroeconomic changes, network-specific advancements, and more general crypto market trends, today’s Stellar price is quite dynamic. XLM is trading at roughly USD 0.11 when writing, which reflects slight intraday fluctuation. With the asset’s 24-hour trading volume of over $70 million, key exchanges, including Binance, Coinbase, and Kraken, show significant market activity.

The live XLM to USD conversion rate, often influenced by Bitcoin’s price action, Ethereum upgrades, and regulatory news from areas including the United States, the European Union, and Southeast Asia, gives consumers a quick view of market valuation.

What Motivates Stellar’s Price Movement?

Dealing with both on-chain indicators and off-chain happenings helps one grasp the factors driving Stellar’s price swings. Regarding the blockchain, network activity, including total transaction volume, new wallet building, and payment provider collaboration, is essential. Still, a significant turning point in Stellar’s economic plan is the burning of tokens in 2019, when the entire supply was cut by half.

Externally, strategic relationships with corporations like IBM for cross-border payments in the Asia-Pacific area have improved Stellar’s price path. MoneyGram chose Stellar in 2022 to support cash-to-cryptocurrencies, portraying it as a real-world use case of blockchain rather than a speculative asset.

Given crypto’s increasing relationship with tech stocks and risk-on assets, more general market cycles caused by Federal Reserve interest rate announcements, inflation data, and geopolitical concerns often have rippling effects on XLM’s price.

Conversion from XLM to USD: Tools & Real-Time Trackers

Traders typically depend on real-time tools and platforms that provide accurate and quick data updates to keep the current XLM to USD live price. With technical indicators, historical data, and price alerts, respected price tracking tools include CoinMarketCap, CoinGecko, and TradingView.

These systems let users map Stellar’s price against not just the U.S. Dollar but also other fiat currencies and crypto pairs, including XLM/BTC, XLM/ETH, and XLM/USDT. Such comparisons help to find arbitrage prospects and grasp Stellar’s performance in the larger crypto market.

Technical Analysis of Stellar (XLM)

Technically, Stellar’s price patterns have shown strong links with important support and resistance levels. Recent price swings have stayed mostly in the $0.10 to $0.12 area; resistance has developed around $0.14. XLM might retest the $0.20 zone if optimistic momentum returns—perhaps via institutional adoption or favorable regulation.

To evaluate market mood, traders commonly use indicators including the Relative Strength Index (RSI), MACD, and moving averages. A breakout from consolidation trends could indicate a trend reversal or continuation, offering both scalpers and swing traders possible entrance and exit opportunities.

Stellar’s Part in Cross-Border Payments

Stellar’s potential to enable seamless international money transfers is among its most convincing value propositions. Anchor integrations—which link fiat currency to the Stellar network—help to do this. Unlike conventional banking systems that charge hefty fees and require several intermediaries, Stellar settles transactions in seconds and at nominal expenses.

Using stablecoins on Stellar—like USDC—helps to improve the network’s usefulness even further. Thanks to Stellar’s low costs and quick settlement time, projects are launching tokens on it, increasingly as a reasonable substitute for Ethereum for financial uses.

Regulatory Positioning and Institutional Interest

Stellar has positioned itself as a compliant blockchain infrastructure as regulatory scrutiny rises across borders. The Stellar Development Foundation has actively interacted with legislators to help create frameworks consistent with EU and U.S. laws and CA (Markets in Crypto-Assets Regulation) in the EU and U.S. laws.

Institutional players are displaying wary hope. Stellar distinguishes itself from meme currencies and highly volatile assets with its orientation toward practical use cases. XLM custody services provided by sites such as Anchorage Digital and Fireblocks reflect increasing institutional trust.

Historical Price Volatility and Performance

Stars have gone through several boom-bust cycles historically. XLM peaked at almost USD 0.93 during the 2017 bull run, then sharply dropped in the 2018 bear market. Its price has changed with the wider crypto cycles since then, but its ongoing development and real-world integration have kept it relevant.

Active GitHub repositories, a community governance approach, and a somewhat low inflation rate point to a vibrant and changing environment. Investors should, meanwhile, be aware of the crypto market’s inherent volatility and the impact of market mood, news events, and liquidity constraints.

Stellar and XLM Price Future Prospect

Stellar’s capacity to draw corporate adoption, change with Web3 interoperability, and support the larger push toward central bank digital currencies (CBDCs) will probably help define its price path. Though no official alliances have yet emerged, reports in 2023 revealed exploratory talks between the SDF and different countries for CBDC experiments.

Should the larger market enter another positive phase, Stellar’s price could increase if it keeps growing its ecosystem while maintaining regulatory friendliness.